Blog

Why Buying a New Home VS Renting is Right for You!

April 22, 2024

Are you on the fence about whether to continue renting or take the leap into homeownership? While both options have their merits, owning a home stands out for numerous compelling reasons that can significantly impact your financial future and overall quality of life. Let's explore why buying a home may be the superior choice:

Building Equity and Long-Term Wealth

One of the most significant advantages of owning a home is the opportunity to build equity over time. As you make mortgage payments, you're essentially investing in your future and building wealth. Unlike renting, where your monthly payments contribute to your landlord's equity, homeownership allows you to benefit from property appreciation and equity growth, leading to long-term financial stability and security.

Stability and Control

Owning a home provides a level of stability and control that renting simply cannot match. You have the freedom to customize your living space according to your preferences, whether it's renovating, landscaping, or making structural changes. This level of control allows you to create a home that reflects your personality and lifestyle, fostering a sense of pride and satisfaction.

Tax Benefits and Financial Advantages

Homeownership comes with several tax benefits that can significantly reduce your overall tax burden. For instance, the mortgage interest deduction allows homeowners to deduct mortgage interest paid on their primary residence, resulting in potential tax savings. Additionally, property tax deductions and capital gains exclusions further enhance the financial advantages of owning a home. Consultation with a tax professional can help you maximize these benefits and optimize your financial strategy.

Long-Term Cost Savings

While renting may seem like a more affordable option in the short term, owning a home can lead to significant cost savings over time. Fixed-rate mortgages provide predictability in monthly payments, allowing you to budget more effectively. Additionally, as rental prices continue to rise, homeownership offers protection against inflation and the potential for lower housing costs in the long run.

Legacy and Generational Wealth

Owning a home enables you to leave a lasting legacy for your family and future generations. Property ownership can be passed down as an asset, providing financial security and stability for your loved ones. This aspect of homeownership goes beyond financial considerations and encompasses the emotional value of creating a lasting impact for your family's future.

Community and Roots

Buying a home allows you to become part of a community, establish roots, and build meaningful connections with neighbors and local businesses. Homeownership fosters a sense of belonging and community engagement, enriching your overall living experience and enhancing your quality of life.

In conclusion, while renting offers flexibility and short-term convenience, the unparalleled benefits of homeownership make it a wise and rewarding investment. From building equity and long-term wealth to enjoying stability, control, and tax advantages, owning a home aligns with key financial and lifestyle goals. If you're ready to take the next step towards homeownership, consult with real estate professionals and financial advisors to explore your options and make an informed decision that sets you on the path to a brighter future.

Latest Posts

April 16, 2024

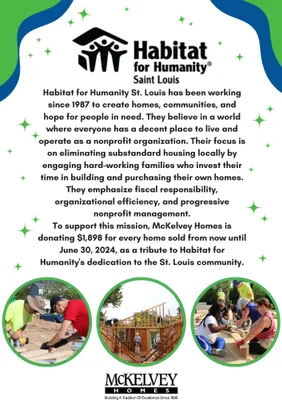

McKelvey Homes Tribute to Habitat For Humanity

April 12, 2024

McKelvey Homes Named 2023 HBA Award Winner

April 12, 2024

Corporate Philanthropy Awards 2024: Second Place for McKelvey Homes in Small Companies Category (1 to 99 Employees)

March 1, 2024

McKelvey Homes Honors St. Louis Ronald McDonald Foundation with $1,898 for Every Home Sold Thru March 31st!

January 12, 2024

Ring in the New Year with McKelvey Homes: Unwrap $20,240 in Free Options!

December 14, 2023

Have You Heard The Good News? Interest Rates Are Falling!

September 12, 2023

Waterfront at Wildhorse Village featured on ABC's American Dream Episode!

August 25, 2023

McKelvey Homes Unveils "The Hamilton Ranch Plan" Display at Cottleville Trails

January 18, 2023

McKelvey Homes Celebrates Groundbreaking Ceremony at The Exclusive Waterfront at Wildhorse Village

Next Article